Written by: Shauna Brooks, Performance and Evaluations Specialist

It’s that time again! As you work with youth to develop life skills, here are some ideas and information to help them prepare for tax season. Remember, taxes must be filed and paid by April 15th.

- FREE stuff! Most youth workers, transition age youth, and low income families can file taxes electronically and get tax preparation assistance at no cost. The Internal Revenue Service (IRS) offers two fee-free benefit programs for those whose annual income amounts to less than $66,000.

- For those with simple returns and a comfort level in filing their own taxes, there is a free-file option with most well-known tax preparation software or online service providers available through the IRS website: https://apps.irs.gov/app/freeFile/

- If circumstances are more complex or help is needed, the IRS website lists local providers of free tax preparation services: http://www.irs.gov/Individuals/Free-Tax-Return-Preparation-for-You-by-Volunteers

- Get Organized. Interpreting tax documents can be tricky, but experienced preparers and online software can help. However, if documents are missing, it can cause a headache for everyone involved and may result in an audit. Before filing, think back to the last year and make sure you have everything you need from any jobs you had or other income you received over the course of the year. Don’t ignore any tax documents! Once you have filed, be sure to store all of your documents and returns in a safe place. The IRS has put together a checklist of things to bring to a tax preparation appointment: http://www.irs.gov/Individuals/Checklist-for-Free-Tax-Return-Preparation. Common tax documents include:

- W-2 Earned Income

- 1099 Miscellaneous Income

- 1098-E Student Loan Interest

- Host a Tax Party! If the scale works for your program, it may be wise to bring volunteers on site. Have fun games like Monopoly, tax Jeopardy, or tax Bingo and snacks to entertain youth while peers meet 1:1 to prepare their taxes. Assist youth in gathering their tax documents by providing checklists in advance and offering secure storage until the big event.

- Money, Money, Money!! Tax refunds may present a rare opportunity for young people or families who struggle to make ends meet. It is so tempting to splurge a chunk of money and so easy to let it slip through your fingers. The best way to get the most out of that opportunity is to make a plan for those dollars before they are spent.

- Help youth define their goals. They might be saving move-in costs for their own apartment (security and utility deposits, first month’s rent, furniture and household supplies) or start-up costs for buying a car (down payment or cash purchase, tags, title, and insurance). Some youth are already buried in debt from predatory pay day loans and are working to free themselves from that burden. Perhaps a young person needs to buy a computer for high school, or to facilitate post-secondary studies.

- Dependent Status. Determine whether or not someone plans to claim you as a dependent. Filing incorrectly could result in problems for you or your parent/guardian. There are four basic tests to establish dependency. According to the IRS, they are:

- Relationship: Taxpayer’s child, stepchild, foster child, sibling or step sibling, or a descendant of one of these.

- Residence: Child has the same principal residence as the taxpayer for more than half the tax year. Exceptions apply for children of divorced or separated parents, kidnapped children, and temporary absences.

- Age: The child must be under the age of 19 at the end of the tax year or under the age of 24 if a full-time student for half of the year, or be permanently and totally disabled at any time during the year.

- Support: Child did not provide more than half of his/her own support for the year.

- In addition to income tax, parents claiming a youth as a dependent also affects qualifying for educational assistance through the Free Application for Federal Student Aid (FAFSA). Learn more about eligibility for homeless or unaccompanied youth status and FAFSA here: https://studentaid.ed.gov/sa/sites/default/files/homeless-youth.pdf

- Extensions. If necessary, a six month extension can be granted by filing form 4868. That will extend the deadline to October 15. This can be helpful for youth who are in the middle of a difficult situation and do not have access to necessary records or other information. However, even if you request an extension, you will still need to pay any taxes you owe by April 15.

Tax time can also come with big risks, particularly for financially vulnerable youth and families. Beware the following pitfalls:

- The surprise 1099-C. Sometimes people negotiate with creditors and some portion of a debt they owe is “forgiven.” A chance to exhale and recover from the financial pressure may well be worth it. Unfortunately, taxpayers are often caught by surprise when they receive a 1099-C tax form, for cancellation of debt, in the mail. In most cases, the value of any forgiven debt of $600 or more is considered taxable income. If you, a co-worker, or a youth or family with whom you are working experience this situation, be aware that a 1099-C will come, and bring it along with other tax documents to a preparer. Cancelled debt that is part of a bankruptcy is not taxable. There is also an exception for insolvency, which often applies in situations where some or all of a debt is forgiven. You will need advice from a professional tax preparer to file correctly and avoid paying more tax than you have to.

- Refund Anticipation Loans (RALs). Interest rates are absolutely despicable, and getting less money two to three weeks earlier (if you e-file with direct deposit) probably isn’t worth how much of your refund you will have to give up to do it. Having a break between learning how much is coming and actually getting it only increases your power to plan how to use it and contribute to your financial goals.

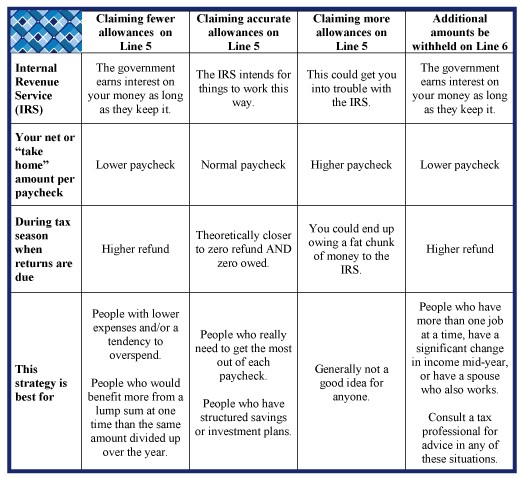

- W-4 allowances: to take or not to take. The number of people (including yourself) supported by your wages affects the amount of your income that is taxed. Most W-4 forms include instructions and a worksheet to help you identify how many allowances apply to your circumstances. Following enactment of the Tax Cuts and Jobs Act in December 2017, changes have resulted in unexpected disappointment or even alarm for taxpayers filing for 2018. Guidelines for employers to withhold taxes from paychecks were affected by eliminating exemptions and shifting the threshold for itemized deductions. As a result, many people who are accustomed to receiving significant refunds will see much smaller refunds or even end up owing additional taxes at the end of the year. Learn more about the new tax law here: https://www.irs.gov/pub/irs-pdf/p5307.pdf.

- Those changes also increase the significance of consequences for each W-4 strategy listed in the table below. You can see how this affects you, and make the best choices for yourself using this IRS withholding calculator.

https://naehcy.org/wp-content/uploads/2017/12/fafsa-tips-uhy2017-18.Dec2017.pdf

http://www.cceh.org/wp-content/uploads/2018/09/SPOC-Homeless_Youth_Tip_Sheet-NAEHCY.pdf

This blog was strictly created to provide tips and resources that you may find helpful. National Safe Place Network does not guarantee any specific outcomes from utilizing the above information.